Car Reimbursement Rate 2020

575 cents per mile driven for business use down from 58 cents in 2019. And believe it or not the average car allowance in 2020 was also 575.

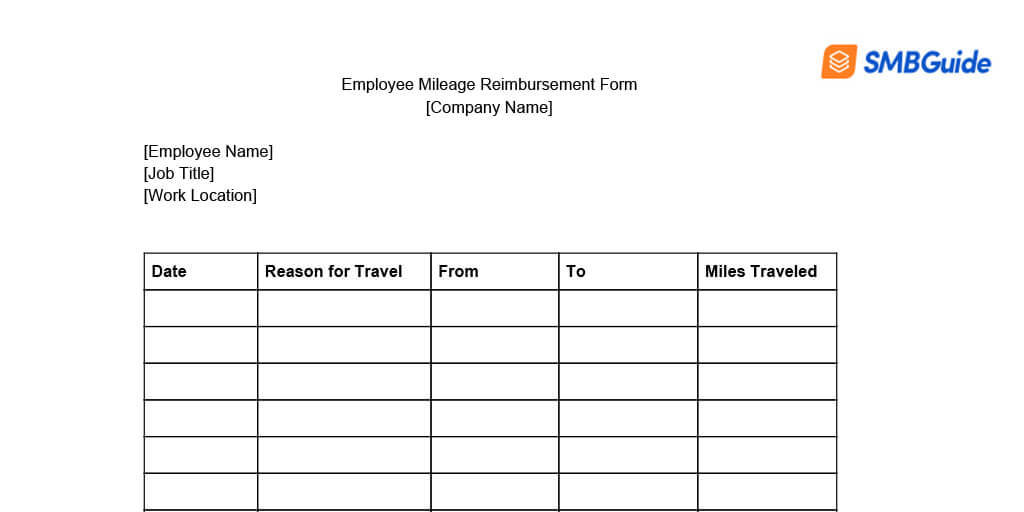

Mileage Reimbursement For Employees Info Free Download

In accordance with 808 CMR 103 4 EEC cannot pay a provider a rate that is higher than the lowest fee charged for the same type.

. The following table outlines the. But for most mobile workers its 575. The charges are typically slightly lower than the 2020 prior year.

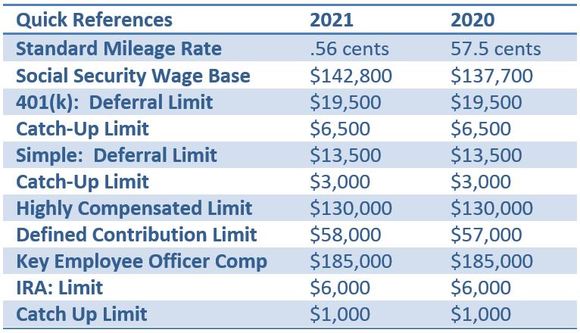

IRS Mileage Rate 2021. Using the Tier 1 and Tier 2 rates. 575 cents per mile for business miles 58 cents in 2019.

Beginning on January 1 2020 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. Hospitals may receive additional payments for products with NTAP status. A candidates committee will report a reimbursement as either campaign expenditure or a noncampaign - disbursement depending on the activity for which the automobile was used.

The rate for 2020-21 and 2021-22 is 72 cents per km for up to 5000 business kms. On September 2 the Centers for Medicare Medicaid Services CMS released updates to the Inpatient Prospective Payment System IPPS final rule for fiscal year 2021 including updates to Medicare payment policies and payment rates for most acute care hospitals. Or 2 as part of a move for which expenses are deductible.

They are the main points for Car Mileage Reimbursement 2021. These were the first two years mobile employees could not write off unreimbursed business expenses. Cents Per Km is one of the methods you can choose to satisfy the substantiation rules for individuals claiming car expenses as a tax deduction.

It absolutely was produced general public in Notice 2021-02 December 22 2020. They are the small print for Car Mileage Reimbursement For Employees. Our platform simplifies the complexities of managing your vehicle reimbursement program.

There are also a number of ways a company can stand up a car reimbursement program. This allowance may be greater for different positions in the company. Ad Simplify the complexities of managing your vehicle reimbursement program with Motus.

575 cents per mile driven for business use down one half of a cent from the rate for 2019 17 cents per mile driven for medical or moving purposes down three cents from the rate for 2019 and. Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. 68 cents per km for 201819 and 201920.

The Tier 2 rate is for running costs only. However the NTAP is limited to 65 of the product cost and no CAR-T products receive NTAP for FY 2021. 056 per mile for commercial purposes.

016 per mile if medically necessary. The Internal Revenue Service announced gas mileage reimbursement rates for 2020 in December. 2020 IRS Personal Car Mileage Rate Change.

056 per mile for commercial purposes. If reimbursement does occur the use of a personal car should be paid at the 2020 IRS Mileage Rate which is 575 cents per mile. The new modified Car Mileage Reimbursement 2021 officially applies as of Jan 1 2021.

Cents Per Kilometre Car Expenses. 2021 Average Car Allowance. In FY 2021 inpatient stays with CAR-T treatment are assigned to MS-DRG 018 which has an average national reimbursement rate of 239933.

Use the Tier 1 rate for the business portion of the first 14000 kilometres travelled by the vehicle in a year. Notice 2020-5 provides that the 2020 standard mileage rate for transportation or travel expenses is 575 down from 58 per mile in 2019 for all miles of business use business standard mileage rate. Download the free guide.

Learn about the true cost of different program options. Effective January 1 2020 the IRS has decreased the mileage reimbursement rate by 0005 to 0575 per mile. The mileage reimbursement per kilometre for a car in the UK is 45 pence for the first 10000 miles and above 25 pence.

EECs daily reimbursement rate for subsidized early education and care is based on multiple factors including the program type the childs age the location of care and the type of care. Kilometre rates for the 2018-2019 income year. This program has a number of other names.

The per kilometre car expense claim rate for 2022-23 is to be 75 cents per km. For 2020 standard mileage rates for the use of cars vans pickups or panel trucks will be. It absolutely was created public in Notice 2021-02 Dec 22 2020.

The prices are generally somewhat reduced compared to 2020 prior year. Daily reimbursement rates. September 4 2020.

Executives for example may receive an allowance of around 800. The 2019 and 2020 tax-filing seasons exposed inadequate car allowances and vehicle reimbursements. The average car allowance in 2021 is 575.

66 cents per km for 201718 201617 and 201516. The Tier 1 rate is a combination of your vehicles fixed and running costs. A car reimbursement is a business vehicle program that reimburses employees at a cents-per-mile rate for the business use of their personal vehicle.

For motorcycles it is 24 pence and for a bike 20pence. 56 cents per mile driven for business use down 15 cents from the rate for 2020 16 cents per mile driven for medical or moving purposes for qualified active duty members of the Armed Forces down 1 cent from the rate for 2020 and. For this year the mileage rate in 2 categories have gone down from previous years.

The 2020 standard mileage rate is 17 per mile down 3 from 2019 for use of an auto 1 for medical care. Rates are reviewed regularly. Now with a pandemic adding economic pressure is the time to re-calculate your vehicle reimbursement.

This includes private use travel. Ad Deciding on the right vehicle reimbursement program is a tricky decision. In accordance with the University travel policy 4041 PDF all mileage reimbursement for University travel subsequent to January 1 2020 is reimbursable at the new rate of 0575.

Mileage reimbursement cents-per-mile program etc. CMS finalized its proposal to establish a Medicare Severity Diagnosis Related. 72 cents per km for 202021 and 202122.

Irs Updates Mileage Rates For 2021 Lswg Cpas

Mileage Reimbursement Rates What You Need To Know Tax Alert June 2021 Deloitte New Zealand

Comments

Post a Comment